Rental Property Calculator: Calculate Income & ROI Instantly

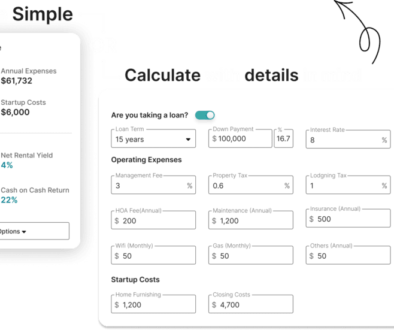

If you’re diving into the world of rental properties, our Rental Property Calculator is your secret weapon! This easy-to-use tool helps you calculate estimated rental income and expenses, ensuring you don’t overlook crucial details. Imagine having the ability to forecast your returns with just a few clicks—sounds like magic, right? By entering simple data about your property, you can see potential profits unfold before your eyes!

Why Use a Rental Property Calculator for Your Short-Term Rental?

Using an investment property calculator not only clarifies where your money will go but also illuminates hidden opportunities for growth. It’s all about making informed decisions; knowing whether a particular rental property will cash flow or drain you dry is key. Don’t let guesswork steer your investments; instead, empower yourself with expert insights that unlock the true potential of real estate. Get ready to maximize profitability and take control of your financial future!

When evaluating rental properties, consider essential metrics like IRR (Internal Rate of Return), CFROI (Cash Flow Return on Investment), and cap rate. These indicators provide a solid foundation for assessing potential returns.

Real-World Influences

Keep in mind that the real world is unpredictable. A short recession might depreciate property values, while a new shopping complex could inflate them. Both scenarios drastically affect your investment’s performance.

Long-Term Assumptions

Be cautious with long-term financial assumptions. Events over decades can bring unexpected surprises, altering projections and affecting profitability. Market fluctuations in maintenance costs, vacancy rates, and monthly rent can further impact your bottom line.

Inflation Considerations

While appreciation of property values is often factored in, inflation might not be, potentially distorting figures over time. Ensure your calculations account for this to avoid surprises.

By combining these insights with the power of an investment calculator, you position yourself to navigate the complexities of real estate investment confidently.

What Are the Challenges and Benefits of Investing in Rental Properties?

Investing in rental properties presents a unique set of challenges, as well as significant benefits. Understanding both can help potential investors make informed decisions.

Challenges of Rental Property Investing

- Active Management: While some might see rental properties as a path to passive income, the reality often involves active involvement. Investors typically step into the landlord role with responsibilities such as:

- Tenant Relations: This includes advertising vacancies, conducting background checks, drafting lease agreements, managing rent payments, and occasionally, handling evictions.

- Property Upkeep: Regular maintenance, repairs, and renovations are crucial to keep the property in good condition and appealing to tenants.

- Administrative Tasks: Setting rental rates, managing tax obligations, budgeting for expenses, and maintaining proper documentation all demand attention.

- Time and Location Constraints: Managing rental properties can be daunting for those with limited time or who live far from their investments. This often leads owners to consider professional property management services, which come with additional costs.

- Financial Intensity and Liquidity: Entering the rental market requires substantial capital, and the investment can be cash flow-dependent with low liquidity. It’s essential to have a sound financial plan in place.

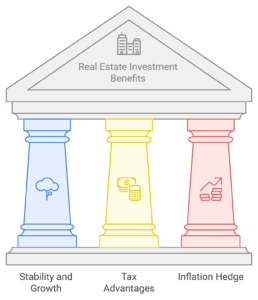

Benefits of Rental Property Investing

- Stability and Growth Potential: Compared to volatile equity markets, rental properties generally offer more stable returns. With the right financial insight, they can yield profits and become a valuable asset in an investor’s portfolio.

- Tax Advantages: Investors can benefit from various tax deductions related to property depreciation, mortgage interest, and maintenance expenses.

- Inflation Hedge: Real estate often acts as a protective measure against inflation, as property values and rental income tend to increase over time.

Outsourcing Management

For investors who prefer a more hands-off approach, hiring a property management company can mitigate many of these challenges. While this service typically costs around 10% of rental income, it can relieve time constraints and ensure professional handling of daily operations.

In summary, while rental property investing demands a significant commitment in time and resources, its potential rewards—stability, tax benefits, and inflation protection—can make it a worthwhile pursuit for savvy investors.

What is the capitalization rate, and how is it calculated and utilized?

The capitalization rate, commonly known as the cap rate, is an essential metric in real estate investment. It serves as a quick measure to compare the potential profitability of different investment properties.

Calculation of Cap Rate

The cap rate is calculated as follows:

Cap Rate = (Net Operating Income (NOI)) / (Current Market Value of the Property)

- Net Operating Income (NOI): This figure represents the total income generated by the property, minus operating expenses. It excludes factors like taxes and financing costs.

- Current Market Value: This is the present worth of the property, influenced by market conditions and valuation assessments.

How is Cap Rate Utilized?

- Quick Comparisons: The cap rate is particularly useful for swiftly comparing multiple properties. A higher cap rate typically indicates a potentially higher return on investment, though it may also involve higher risk.

- Historical Insights: By examining past cap rates of a property, investors can gauge previous performance trends. This historical perspective can help in forecasting future performance.

- Complex Evaluations: In scenarios where determining NOI for a specific rental property is tricky, methods like discounted cash flow analysis provide a more comprehensive evaluation alternative.

In sum, the cap rate is a straightforward, yet powerful tool for investors to assess property investments and make informed decisions about potential returns and risks.

How is the Internal Rate of Return (IRR) used in evaluating rental property investments?

When evaluating rental property investments, the Internal Rate of Return (IRR) serves as a crucial metric. It calculates the annualized rate of return on each dollar invested over the time it remains in the investment. This makes IRR an indispensable tool for comparing the potential profitability of various investments.

Investors favor IRR because it provides a more comprehensive picture of profitability compared to other measures. For instance, while capitalization rate offers a basic snapshot of returns, it doesn’t consider the impact of time on money. Similarly, Cash Flow Return on Investment (CFROI) overlooks the time value of money altogether.

Why IRR Is Essential

- Comparative Analysis: By using IRR, you can directly compare the anticipated profitability of different rental properties, regardless of their size or investment period.

- Time Value Consideration: IRR incorporates the time over which the investment grows, setting it apart from simpler metrics that ignore this important aspect.

- Decision-Making Insight: A higher IRR means a more attractive investment, guiding investors toward opportunities with better returns.

In summary, IRR is invaluable for real estate investors looking to make informed decisions about rental properties by factoring in both profitability and investment duration.

What responsibilities does a landlord have when managing a rental property?

When managing a rental property, a landlord takes on a variety of responsibilities that ensure the property’s smooth operation and the tenants’ satisfaction. Here’s a breakdown of key duties:

Tenant Management

Landlords are responsible for attracting and selecting dependable tenants. This involves advertising the property, conducting thorough background and reference checks, and crafting legally sound lease agreements. Additionally, landlords must collect rent promptly and handle the process of evicting tenants if the lease terms are violated.

Property Maintenance

Ensuring the property remains in good condition is another crucial duty. This includes conducting repairs, performing regular upkeep, and planning necessary renovations. A well-maintained property retains its value and keeps tenants happy.

Administrative Duties

A landlord must also manage various administrative tasks. This includes setting competitive rent prices, managing property-related expenses, and overseeing employee payroll if staff like maintenance workers are involved. Additionally, handling tax filings and maintaining accurate financial records are crucial to staying compliant and financially viable.

A landlord must also manage various administrative tasks. This includes setting competitive rent prices, managing property-related expenses, and overseeing employee payroll if staff like maintenance workers are involved. Additionally, handling tax filings and maintaining accurate financial records are crucial to staying compliant and financially viable.

In summary, landlords juggle tenant relations, property care, and administrative tasks to successfully manage rental properties. By doing so, they not only preserve the property’s value but also foster a positive living environment for their tenants.

What is the role of property management companies in rental property investing?

Property management companies play a pivotal role in the world of rental property investing by shouldering the array of responsibilities that come with managing rental properties. These firms offer a suite of services that can prove invaluable for investors.

Key Responsibilities

- Tenant Management: Property managers handle all aspects of tenant relations, from marketing the property and screening potential tenants to signing leases and resolving tenant issues. This alleviates the stress of direct interaction for landlords.

- Maintenance and Repairs: They ensure the property remains in good condition by scheduling routine maintenance and addressing repair requests promptly. This service safeguards the property’s value and keeps tenants satisfied.

- Rent Collection: Property management companies streamline the rent collection process, ensuring that payments are collected on time and managing any delinquent accounts. This steady cash flow is critical for investors.

- Legal Compliance: Keeping up with local, state, and federal regulations is essential. Property managers ensure the property complies with all laws, reducing the risk of legal issues for owners.

- Financial Management: Many companies offer financial reporting services, allowing investors to track income, expenses, and overall performance. This transparency is vital for making informed decisions.

Who Benefits?

- Time-Strapped Investors: For those who lead busy lives, employing a property management company frees up valuable time while ensuring their investment is running smoothly.

- Remote Owners: Investors who live far from their rental properties can rest easy knowing that local experts are managing their assets.

- Hands-Off Investors: Some investors prefer not to be involved in day-to-day operations and entrust those duties entirely to professionals.

- Budget-Wary Owners: Although property management services usually charge around 10% of the rental income, the peace of mind and efficiency they provide can outweigh the cost for many owners.

In summary, property management companies are essential facilitators for rental property investors, offering comprehensive solutions that streamline operations and enhance the profitability of rental investments.

What other types of real estate investments exist besides rental properties?

While rental properties are a popular choice among real estate investors, there are several other avenues to consider:

Real Estate Investment Trusts (REITs)

These are entities that pool capital to invest in real estate portfolios. By purchasing shares of REITs, investors can diversify their portfolio with minimal hassle, avoiding the complexities of traditional property transactions. Depending on the nature of their listing, REITs can be publicly traded, private, or public non-traded. They typically provide a steady stream of passive income alongside conventional investments like stocks and bonds.

Buy and Sell: Real Estate Trading

Often referred to as house flipping, this strategy involves purchasing properties with the intent to sell them for profit in a short period. This can involve renovating the property to increase its value or sometimes merely capitalizing on market trends without renovations. Success in buy-and-sell ventures requires a solid grasp of market dynamics and property valuation.

Wholesaling

Wholesaling is a quick-turnaround strategy where the investor, or wholesaler, identifies lucrative deals, secures them under a contract, and then sells the contract to another buyer. The key here is never owning the property itself, thus minimizing risk. It’s a strategy that heavily relies on networking and negotiation skills.

These alternatives to rental properties can offer excellent returns, provided you approach them with the right knowledge and strategy. Consider diversifying your real estate investments by exploring these options to match your financial goals and risk tolerance.

What is the process and purpose of buying and selling real estate for profit?

Understanding the Process and Purpose of Buying and Selling Real Estate for Profit

At its core, buying and selling real estate for profit—often referred to as real estate trading or house flipping—is about leveraging market knowledge to capitalize on property value increases. Unlike traditional rental property investments, this approach typically doesn’t involve managing tenants or long-term leases.

The Process Involved:

- Market Analysis: Success begins with a thorough understanding of real estate market trends. This involves researching neighborhoods, price patterns, and potential growth areas.

- Property Acquisition: Savvy traders look for properties with profit potential. This typically means buying under-valued properties or those needing renovation.

- Making Improvements: Many investors opt to enhance the property’s appeal and value through strategic renovations or repairs. However, some may choose to sell properties “as-is” if market conditions are favorable.

- Sales Execution: Timing the sale is crucial. Investors aim to sell when market conditions are optimal for obtaining the highest return on investment.

The Purpose:

- Profit Maximization: The primary goal is to buy low and sell high within a short time frame. This strategy can yield significant profits when executed effectively.

- Capitalizing on Market Opportunities: Astute investors stay ahead by identifying market gaps where they can buy properties in emerging areas or during temporary downturns.

- Diversifying Investment Portfolios: Engaging in real estate trading diversifies investments and offers potential income streams distinct from traditional stock market avenues.

By mastering both the process and the purpose, investors can navigate the complex world of real estate trading, capitalizing on trends to maximize their returns.

What is wholesaling in the context of real estate investments?

In the world of real estate investments, wholesaling is a unique strategy that allows investors to profit without ever owning a property.

The Basics of Real Estate Wholesaling:

- Identifying Properties: The process begins with identifying undervalued properties or motivated sellers. These properties often need renovation or are being sold due to financial distress, making them ripe for investment.

- Securing a Contract: Once a promising property is found, the wholesaler negotiates and secures a purchase contract with the seller. This contract outlines the terms of the sale, including the agreed-upon price.

- Assigning the Contract: Rather than purchasing the property, the wholesaler then assigns the rights of the contract to a third-party buyer. This buyer could be a house flipper, landlord, or another real estate investor looking for deals.

- Profiting from the Sale: The wholesaler makes a profit by charging a fee for their services. This fee is the difference between the price agreed upon with the seller and the amount paid by the end buyer.

Key Advantages:

- Minimal Capital Required: One of the biggest advantages of wholesaling is that it doesn’t require significant upfront capital, since the wholesaler never actually buys the property.

- Low Risk: Because the wholesaler isn’t taking ownership, they avoid many of the risks associated with holding property, such as market fluctuations or maintenance concerns.

Conclusion:

Wholesaling offers a viable entry point into real estate for those looking to maximize profits with minimal investment. By effectively serving as an intermediary between sellers and buyers, wholesalers can earn substantial returns while navigating the complexities of the real estate market.

FAQ

-

A Rental Property Calculator is a tool that helps property investors assess the potential profitability of rental properties by estimating income, expenses, and cash flow. To fully understand rental income sources, it’s essential to consider the various ways these investments generate revenue:

-

Regular Cash Flow: Investors receive consistent income through rental payments made by tenants, typically on a monthly basis. This steady stream of cash flow is a primary income source for property owners.

-

Property Appreciation: Beyond monthly income, rental properties can increase in value over time. This appreciation offers investors the opportunity for a significant one-time return when the property is sold.

Together, these income streams provide both immediate and long-term financial benefits, making rental properties a potentially lucrative investment. By using a Rental Property Calculator, investors can better predict and plan for these income sources, ensuring a comprehensive evaluation of their investment’s potential.

-